WealthFactor: Our Story

WealthFactor looks and acts differently from a traditional advisory firm or financial technology company. And this is by design. WealthFactor is a digital wealth services company designed for you. Our goal is to make managing your wealth simple, accessible, and transparent. After all, you built your wealth and you are the steward of it, so you should be in control of the process.

WealthFactor makes that possible. But how and why we’ve set up WealthFactor this way takes some explaining. To get us started, let’s first look at the entire financial services industry and its influence on WealthFactor.

HISTORY, INDUSTRY STANDARDS, & THE WEALTHFACTOR WAY

In order to talk about how WealthFactor is different, we need to examine two things:

- The shortfalls we have found in the industry.

- The delivery methods for wealth services that are currently available.

First, our founder, Bill Woodruff, realized after decades in the wealth management industry, that a few things were broken.

- You’re overpaying.

- Nearly all financial advisors aren't actual subject matter experts.

- The system puts the advisor at the center and in control, instead of you.

Here’s how he figured this all out…

In college, Bill took a job with a brokerage firm as a stock broker trainee. After spending the first month studying and obtaining his series 7 license, he moved into cold calling to sell stocks. Essentially, this job was “pitching the idea that the firm could pick and time stocks,” says Bill.

It was an eye opener.

Bill realized that the industry worked because of salesmanship, not actual expertise in the market or its history - nothing based on actual evidence.

As he finished his undergraduate degree, Bill accepted a role as an assistant trader at a hedge fund. This role was tasked with building systems to facilitate complex investment strategies. The firm started a fund of hedge funds - a hedge fund that invests in other hedge funds. Bill saw this as an expensive fund that invested in other expensive funds. The primary audience for this “fund of funds” was brokers who would sell the fund of funds to their clients. These brokers expected to get paid by the fund itself to avoid having to charge their customers directly for their services. If they were getting paid by the fund, they’d choose what funds to sell based on what pays them the most rather than what fund might be in the client’s best interest.

Ultimately the client was paying very high fees to line the pockets of brokers and hedge fund managers - yet all these layers and complexity and inefficiency added risk, but limited the potential to benefit the client.

This inefficiency, high fees, and ultimately higher risk (to make up for high fees), is what led Bill to create WealthFactor, whose goal is to make managing wealth simple, accessible, and transparent.

“The investment world has intentionally created the illusion that when you hire a financial advisor, you are hiring an expert, but that person does not likely have a background that would qualify them as an expert. They usually outsource the investing to fund companies or managers to try to get the returns desired,” says Bill.

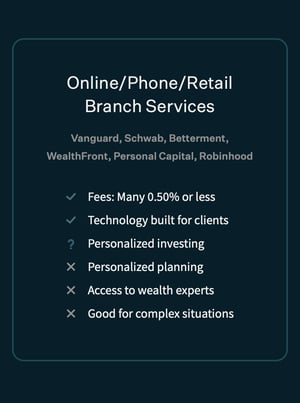

Second, clients today typically have two options for managing their wealth.

- TRADITIONAL: They can work with a traditional wealth advisor, whether that’s an independent registered investment advisor, or one that works at a big financial firm like Morgan Stanley, Wells Fargo, UBS, Goldman Sachs, JP Morgan, Fisher Investments or the like.

- ROBO/ONLINE: They can use a robo-advisor such as an online service like Betterment or WealthFront, or a phone/retail branch style service like Personal Capital, Vanguard, Fidelity or Schwab. This tends to tilt more to a DIY approach to wealth management.

Of course there are positives and negatives for both options.

TRADITIONAL PROS AND CONS

With the traditional route, clients can expect to receive personalized planning that’s good for complex situations, but also pay more for that service, often with less subject matter expertise and technology that isn’t built for the client, but the advisor (which isn’t ideal if the goal is to keep you as the steward of your wealth).

Some common pain points we often hear about the traditional wealth service model are:

- It’s not clear what I’m actually being charged for.

- When I have questions, getting a hold of my advisor can be a challenge.

- The website is difficult to navigate and understand.

The typical cost is an average of 1% of assets and that might not include other costs and fees.

ROBO/ONLINE PROS AND CONS

With the robo route, clients can expect technology that’s actually built for them (which is a big improvement), and lower fees (a win!), but if they have complex needs or require expert advice, that may be hard to find, or at least difficult to get ahold of someone who can actually help.

Some common pain points we hear about often with this model are:

- When financial scenarios get complicated, this service doesn’t serve me well and I’m left navigating my situation alone.

- I’m skeptical of financial advisors, hence why I usually tackle it on my own.

- I don’t feel in control of my wealth.

The typical cost is 0.5% of assets or less.

Our founder thought there should be a better option!

THE WEALTHFACTOR WAY

In an industry built around the financial advisor generalist, we have reimagined wealth services by removing the parts that don’t work and reworking the parts that do.

Here’s how:

Our technology - Through our platform, each client maintains their position as director of their wealth while our technology offers both robust wealth management tools and access to right-fit experts.

-

- Designed for you, not a financial advisor.

- Offers robust wealth management tools.

- Offers access to real, right-fit wealth experts.

Our experts - By cutting out unnecessary layers of people and processes, our clients have direct access to the expertise they need while maintaining control of their wealth, all through our user-friendly, secure platform.

-

- Provide personalized planning and investment services.

- Help with complex situations like tax, estate, and more.

Our cost - Does it seem too good to be true that we can offer the best part of both the traditional model and the robo model and still provide it for less cost? No, because by cutting out unnecessary layers of people and processes, and instead focusing on the efficiency found by leaning into technology, we can offer real wealth expertise only when you need it via a user-friendly, secure platform.

-

- Only 0.65% of assets up to $1 million, and 0.35% thereafter.

Bill created WealthFactor with component parts that are different and actually efficient.

Integrated services and technology in a single platform designed for clients removes unnecessary fees and risk. That leaves WealthFactor’s team of Wealth Experts to work one on one with those who have more complex needs whether that be investing, planning, tax, and estate situations.

“I describe the path we are on as a sort of self-fulfilling vision - lower fees, reduced the pressure I had to utilize riskier investing techniques. The simpler it became, the lower the fees could go. The simplicity and lack of layers came out of this desire naturally.”

OUR EXPERTISE MODEL

The human factor of WealthFactor includes a team of subject matter experts ready to help you organize your portfolio, strategize and plan for what’s ahead, and invest based on your right-fit amount of risk.

Our team is composed of two groups, uniquely prepared to assist you as you navigate your platform and to be available should your needs become more complicated than you can tackle yourself.

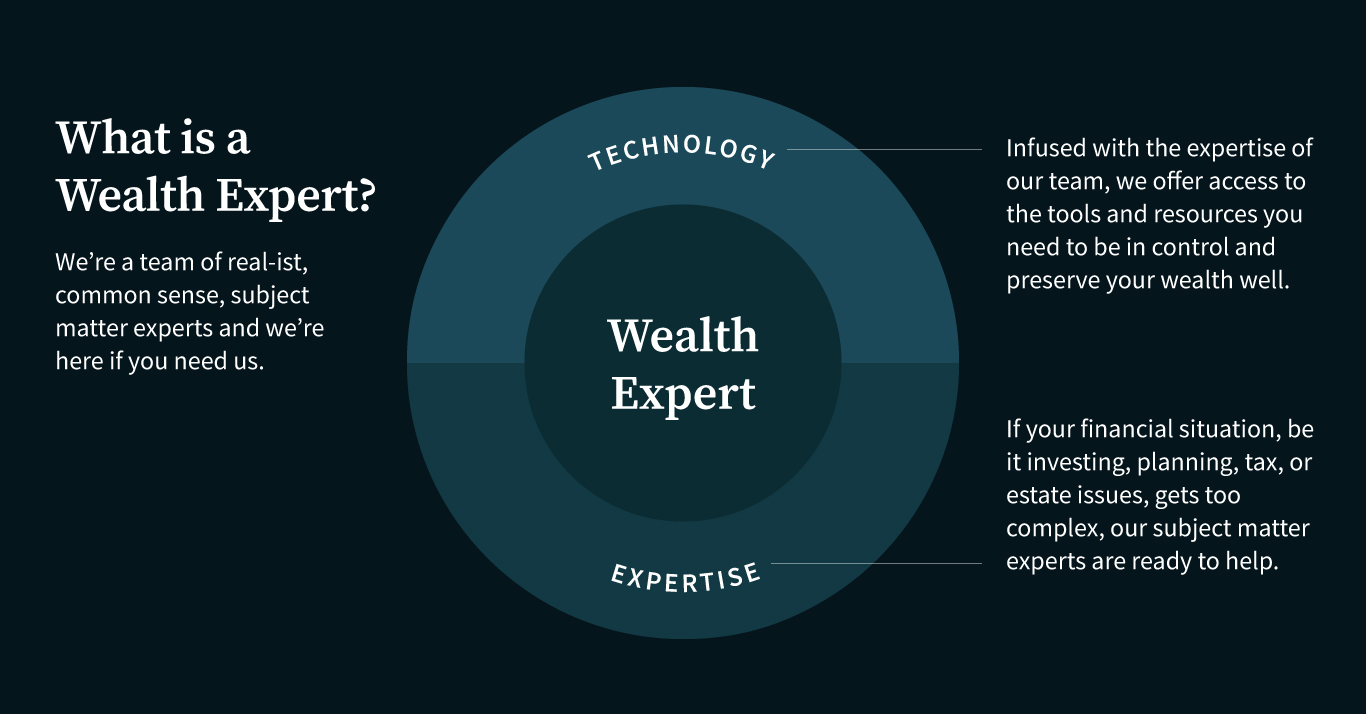

OUR WEALTH EXPERTS

First, We are actual experts in our respective fields, not financial generalists. So the idea at WealthFactor is, you can build your own right-fit team, and only pay for that expertise if you need it.

Here’s what you can expect from these Wealth Experts:

WealthFactor Experts = Real Experts

Rather than building our business around deploying wealth advisors, asking them to go out and gather assets in the form of new clients, manage your money, help you plan, connect you with outside experts, etc, we've done things differently.

If you stop and think about it, are the skills needed to go out and sell someone on becoming a client the type of strengths or skills needed to navigate the complexity of global financial markets or tax and estate law? And are the outside experts an advisor is recommending (like a CPA or estate attorney) due to a reciprocal relationship rather than because they are a right-fit expert for you?

At WealthFactor, you are in control of building your team of experts based on your specific areas of need.

We think of ourselves as real-ist experts. We won’t tell you what you want to hear, but instead will use the data before us to provide you with the truth about your financial situation and look ahead to what is possible based on actual evidence. In essence, we are truth tellers and we’ve noticed that clients find this approach to be refreshing compared to other offerings in our industry.

WealthFactor Experts = Personalized

It’s common in the wealth services industry to set you up in an investment or planning model that requires very little personalization and that is intended for efficiency. The problem is that your individual needs aren’t fully considered and attended to, meaning you are paying a high price (often at greater risk to make up for that higher price) for a less than personalized solution.

At WealthFactor, our experts do not “set it and forget it.” Instead, our methodology utilizes personalized indexing because we know that no two clients have the same risk profile income needs, tax situation, or investing preferences. To assume so would be short sighted.

Not only can our experts provide this personalized approach, but with technology built for you, you remain in control - utilizing only the tools and resources you want and only paying for the services you need.

WealthFactor Experts = Accessible

One of the biggest benefits of WealthFactor is the blend of technology and expertise. Rather than having to choose between the positive parts of a traditional wealth advisor and the pros of the robo/online advisor world, WealthFactor does both better. The outcome is accessibility.

You have access to the tools and resources you need to not only preserve your wealth, but control whether you are emphasizing things like stability versus growth. And in the event that your investing, planning, tax, or estate situation gets complex beyond your own expertise, our experts are just a call or click away.

And when you do need an expert’s help, you know that there’s real people here, ready to assist you.

The bottom line is this: at WealthFactor we don’t take lightly the need for real expertise. And we understand that you might not always need help. So, you shouldn’t be paying the industry standard 1% for bundled services year after year when you may only need expert help once every few years.

We’re a team of real-ist, common sense, subject matter experts.

OUR WEALTH CONCIERGE

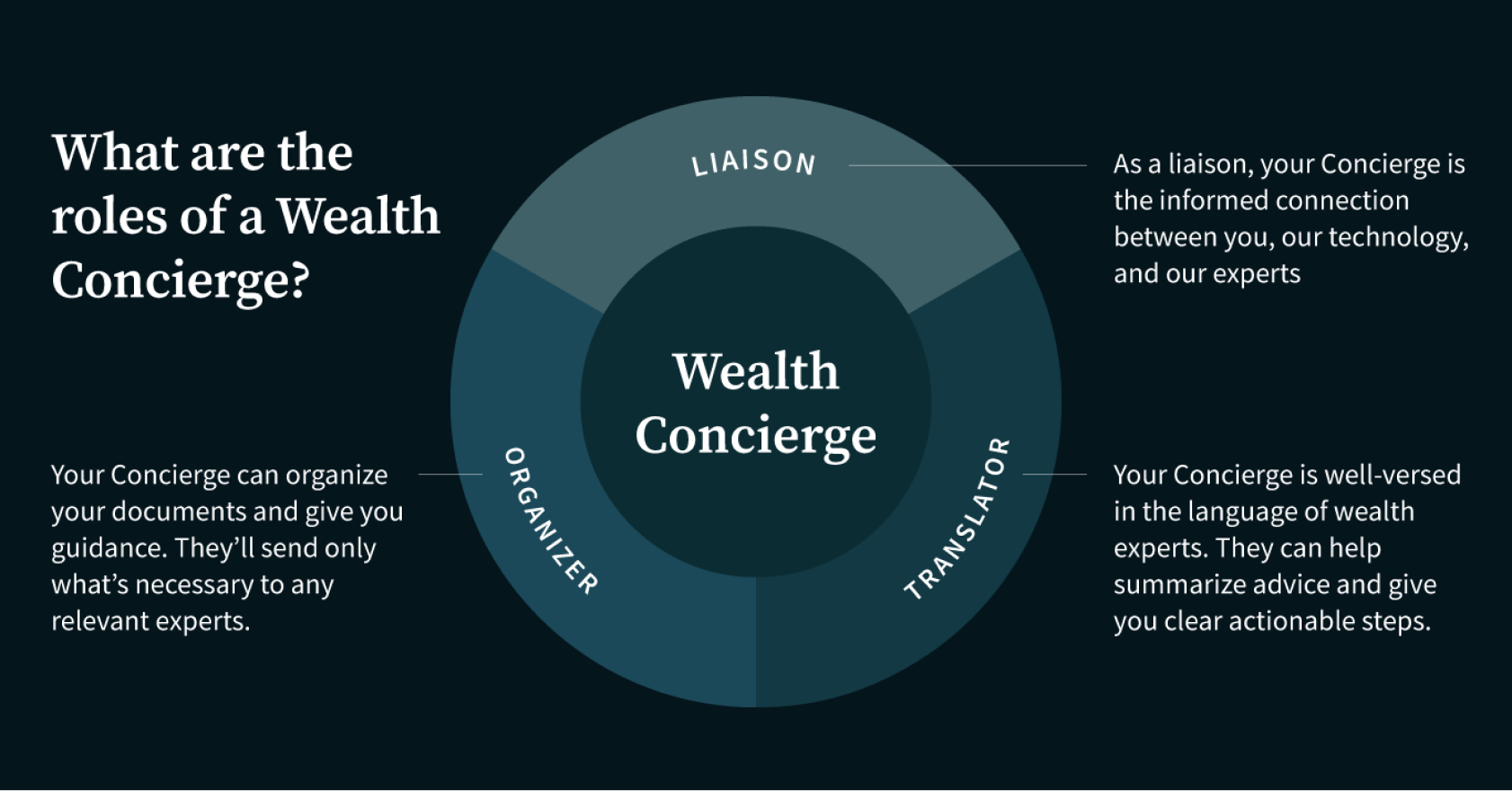

You benefit from our Wealth Concierge services just by being a client. Our concierge team is here to help establish your accounts and answer questions you may have while navigating our platform.

See, it’s this balance of “technology-guided” with the “white glove” comfort of knowing we’re here if you need us - and when we say here, we mean a real, life human answering your call for help, not a robo-advisor.

Here’s what you can expect a member of the Wealth Concierge Team to provide for you:

Concierge = Liaison

Just as a hotel concierge is the well-informed, friendly face who can effectively facilitate your introduction to the city in which you are vacationing, so is our Wealth Concierge the well-informed liaison between you, our technology, and our experts.

Technology Liaison to assist if…

- you’re having trouble logging in, uploading a document, or getting connected.

- you’re confused in any way about how to use a tool or dashboard element.

- you have any questions and would like to speak to a real human!

This is the human factor of WealthFactor - yes we provide robust technology, but we also are backed by real humans you can talk to.

Expert Liaison to assist when…

- you’re being onboarded to work with an Expert - sometimes this requires sharing of additional documents, moving money, or the like. The Concierge will make it easy!

- you’re not sure if you should reach out to your Expert with a question - the Concierge is always available!

- you’d like a main point of contact for WealthFactor - the Concierge is it!

“I’ve noticed that clients sometimes feel bad bothering an Expert with a question and feel more comfortable coming to me instead,” says Brie Valant, Head of Concierge Services. “That’s what I’m here for - to assist with any needs and elevate those needs to Bill or Patrick or Jim, if needed.”

Concierge = Organizer

We know pulling together the necessary documents to work with an Investment, Planning or Tax Expert can be daunting. And if they are a mess, it can be embarrassing.

But not to worry… our Wealth Concierge is that contact at WealthFactor that will assist with document sharing, and organizing all the important components.

They are also working behind the scenes supporting our Experts as needed because having the most efficient processes and removing any layers that hinder that efficiency is how WealthFactor can best serve you.

Concierge = Translator

You know that awkward moment when you feel like you should understand what a financial expert just said, but it would be embarrassing to ask for clarification as their comment goes right over your head?

We know it can happen - each client is different and some may be more knowledgeable than others when it comes to the language we use in the wealth services world. Rather than assuming you know or talking down to you, our Concierge serves as a bit of a translator, offering practical applications and summarizing next steps so you know exactly what to expect.

Our Concierge Team has seen it all. They are a wealth of knowledge, tips, and best practices to make your experience better.

“It’s especially important in this technological industry that people have a human connection because we are handling an important component of people’s lives,” says Brie. “Clients can know that I’m going to follow up on everything on their behalf and that I’m here to assist in any way I can.”

At WealthFactor you will NOT be handed off to a member of the client services team and then forgotten. Instead, a Wealth Concierge will be part of your team from the beginning and a resource you can continue to return to.

That’s the human factor of WealthFactor.

Meet our Wealth Concierge team.

WHAT THIS ALL MEANS FOR YOU

To wrap things up, here’s the basic facts about WealthFactor. You can think of these as promises - that we will be who we say we are.

FACT 1: WE PROVIDE SIMPLE, ACCESSIBLE, AND TRANSPARENT WEALTH SERVICES.

The current model of wealth management is this:

- You work with an investment advisor.

- That advisor isn’t a subject matter expert and often outsources specific work (like investing) to others - they act as a financial generalist, a middleman.

- This outsourcing costs more money because there are layers of processes and people to pay for.

- You end up paying 1% or more for their services.

- To offset the cost of higher fees, your advisor recommends riskier investments.

- The end result is higher cost, more complexity, unnecessary risk, and mediocre advice from your trusted partner.

This is not simple! Or accessible. Or transparent.

Instead, WealthFactor offers the following:

- 0.65% fee on assets up to $1M, and only 0.35% after.

- Robust technology that gives you the tools you need to manage your money well.

- Plus, if you need help with more complex situations, you have access to REAL subject matter experts.

No unnecessary layers, no extra fees, no unnecessary complexity.

This is simple. And accessible. And transparent.

We believe…

- low costs reduce the pressure to recommend more risk in order to achieve financial goals.

We are committed to…

- cutting out unnecessary layers of people, processes, and complexity.

FACT 2: WE PLACE OUR CLIENTS IN CONTROL.

Traditionally, wealth management technology and client services are built for the advisor, not for the client, meaning they are designed to make the advisor’s job as easy as possible, rather than improving the client experience.

The robo/online experience isn’t much better. Although the tech is built for the DIY investor, it lacks access to expertise when your situation gets too complicated to manage on your own.

The outcome of both situations is this - the client isn’t in control.

Instead, WealthFactor offers the following:

- Technology built for you with free tools and resources.

- Access to real wealth experts ready to help you organize your portfolio, strategize and plan for what’s ahead, and invest based on your right-fit amount of risk.

- Additional help from our concierge team for establishing your accounts and answering questions you may have while navigating our platform.

We believe…

- you should be the steward of your wealth and that we can help you preserve it - you’re in control, not us.

We are committed to…

- only charging you for services that you need or will use.

- providing greater access to real subject matter wealth experts if you need them.

- not making you choose between using a financial generalist or using a robo/online platform, because we do both better.

FACT 3: WE TAKE RISK SERIOUSLY.

Remember from Fact 1 that traditional advisors recommend higher risk as a way to offset their high fees?

Well, in this model, risk is often also an afterthought - something that is just assumed to make enough return to make the client feel ok about the idea they are paying an “expert.”

While we believe in markets and that increasing the target allocation to stocks creates the potential for higher returns over time. We see far too many investors have the wrong amount of risk and then deviate from their investment plan.

Our experience suggests deviating from an investment plan is likely the single greatest reason investors are not able to achieve returns commensurate with the markets. Having an investment plan built around the right amount of risk for you is critical.

Instead, WealthFactor offers the following:

- Focus on your risk from the beginning, even before considering financial goals or desired returns.

- Determining your behavioral risk capacity (at what level of risk might you increase the chance of making an investing mistake).

- Measuring your structural risk capacity (the level of risk your finances can withstand).

- Investment advice and strategy formulated around your right-fit amount of risk, unique to you.

We believe…

- you should not take any unnecessary risk.

We are committed to…

- maximizing the potential for success.

These are the promises we make to our users and clients. These are the facts upon which this company is founded.

WealthFactor is doing things differently, not for the sake of different, but because it’s the right way to steward in this industry.

These are the promises we make to our users and clients. These are the facts upon which this company is founded. |

WealthFactor is doing things differently, not for the sake of different, but because it’s the right way to steward in this industry.

Schedule a time with Bill Woodruff, our Founder, to get your questions answered and to learn more about the difference you’ll experience with WealthFactor. Not ready to talk? Meet our Wealth Concierge Team. |