2018 Year-End Market Insights

While it is worth the time and energy to establish an efficient portfolio, financial markets don’t provide straight line returns and often the largest factor to a successful outcome is discipline.

Taking a step back periodically and looking at things with a long-term perspective makes staying disciplined easier.

While it may be natural to draw predictive conclusions by looking for patterns in the charts shared in this piece I’d caution this sort of thinking as the market rarely repeats itself.

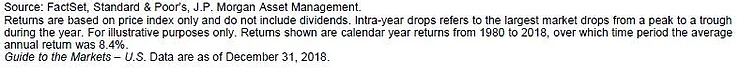

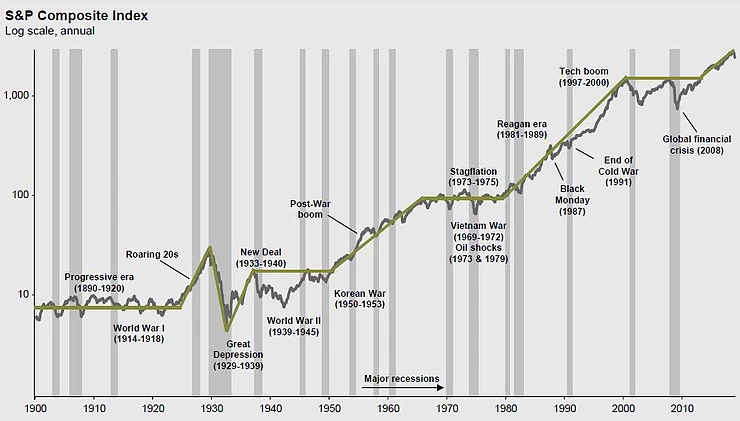

The following graph puts the 2018 equity market results and downside into a longer term context.

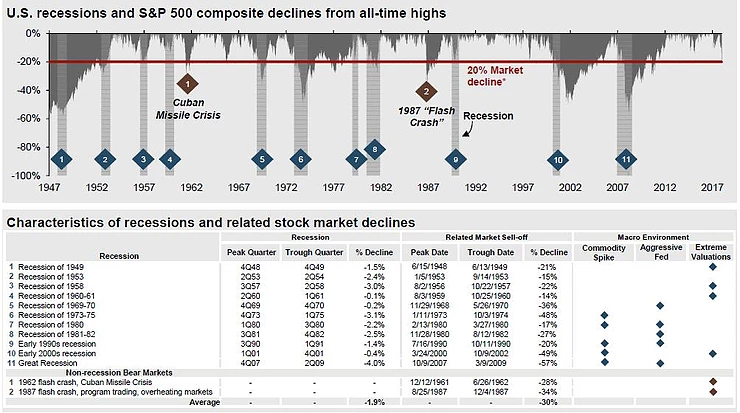

The following graph is an interesting analysis of prior recessions and related declines the stock market.

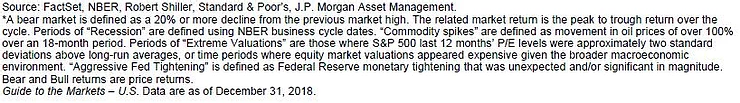

The media tends to sensationalize the point change for an index. This isn’t useful to investors. This graph puts the S&P into a logarithmic scale. This allows for better perspective relative to time frame and magnitude.

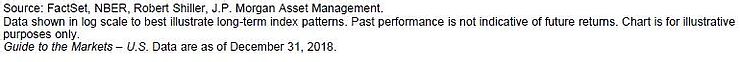

The following is a rolling period analysis which may be useful in assessing what the proper time horizon is for an investment. While past results aren’t indicative for future returns this does provide a basis for the proper investment time horizon for the equity portion of a portfolio.

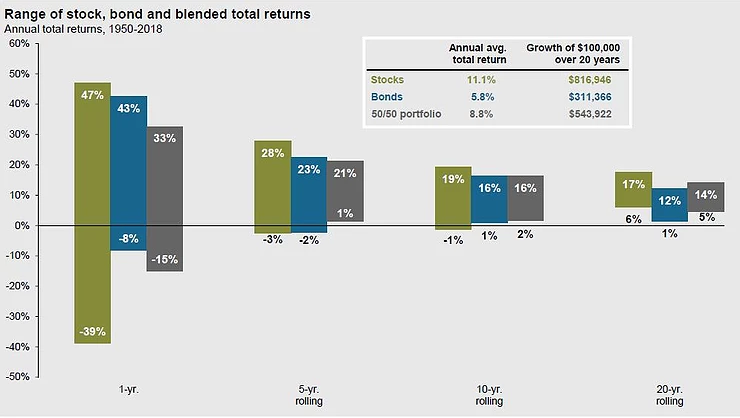

This graph shows the impact the Federal Reserve Bank has had on short-term interest rates since it started its tightening cycle. This graph illustrates the importance to understand the Fed’s limited impact on the intermediate and longer maturities as those rates in some cases have fallen over some prior periods.

US Treasury Yield Curve

The key to success is creating a customized and efficient investment plan that each investor can stick with and implement it in an unwavering disciplined way. The goal of sharing this information is to provide a framework for discussion to help investors look past the short-term volatility and noise that global financial markets inherently contain.

WealthFactor, LLC. All rights reserved. We are located in Lake Oswego, Oregon. A copy of our Form ADV Part II is available upon request. This material is provided for educational purposes only and contains the current opinions of the authors (as of the date appearing on this material), which may change without notice. This material includes information drawn from third-party sources believed reliable but not independently verified or guaranteed by WealthFactor. We do not represent that it is accurate or complete, and it should not be relied on as such. This material does not constitute investment advice or contain investment recommendations, which would need to take into account a client’s particular investment objectives, financial circumstances and needs. Investments and strategies discussed herein may not be suitable for all readers, and you should consult with an investment, legal, tax, and/or accounting professional before acting upon any information or analysis contained herein. This material does not constitute an offer to buy or sell any security or to participate in any investment strategy, and may contain statements based on forward-looking asset class return, risk, correlation, tax and other modeling assumptions. Forward-looking statements expressed herein are subject to may risks and uncertainties related to the underlying assumptions and modeling processes. Actual portfolio results may vary materially from hypothetical results expressed herein due to market, data, modeling and other risks. Past performance does not guarantee future results. The information, ideas and context expressed herein are confidential, proprietary, expressly copyrighted and may not be sold, reproduced, republished or distributed in any way without WealthFactor’s prior written consent.