WealthFactor: Investing

As a digital wealth services, company, WealthFactor not only functions differently, we also manage your investments differently too - offering a personalized approach, backed by real wealth experts and robust technology.

In this post we explain it all - from our RiskSmart approach to the why behind our investment decision making, to how our experts utilize technology to make it all happen in a way that is simple, accessible, and transparent for you, the steward of your wealth.

WHAT IS RISKSMART? And HOW DO I ATTAIN IT?

With our promise to provide wealth services that are simple, accessible, and transparent, that means you won’t find empty promises or unrealistic goals that can only be met by taking unnecessary risks.

Instead, you’ll find a healthy dose of optimism that’s informed by our unique approach to wealth services - an approach that starts with an evidence-based foundation of realism upon which we then build smart.

THE REALISTIC TRUTH

This industry, the wealth management and financial services world, is overly complicated on purpose. Yes there are areas where expertise is necessary, but the layers of complexity, hidden interests, and high fees aren’t and should not be the factors that are determining your risk taking.

We believe risk shouldn’t be informed by your need to hit a financial target to make up for high fees. Unnecessary risk increases uncertainty.

What the real-ist experts at WealthFactor know and teach is these 4 simple keys to success:

- Do not overpay - avoid unnecessary layers and the industry average of 1%

- Safeguard your assets - use an independent custodian and a fiduciary advisor (because independence is freedom)

- Have a plan - for your wealth, your legacy, and your investments (consider nothing in isolation)

- Stick to the plan - work with only servant-hearted stewards of your wealth (afterall, you built your wealth and now is the time to shepherd it well)

LET’S BE RISKSMART ABOUT IT

At WealthFactor, we believe having a plan and sticking to it tends to be as important as portfolio specifics, however, through intelligent processes and integrated systems we offer optimized solutions for each client.

Our pursuit of efficiency allows us to charge less, and leads to reducing forced risk taking often seen across the industry. This idea of “high costs force increased risk” is at the core of our investment philosophy we call RiskSmart.

When building a client portfolio, we utilize evidence-based investing with indexes as the primary starting point. Our systems allow for client-level optimizations for things like yield, taxes, factors, social responsibility, or exposure exclusions. Excluding positions can be useful for clients with large real estate holdings or employer stock options.

Without getting into the weeds too much yet (the weeds come later in this post!), we say all of this to explain that we tirelessly think about risk and how we can best minimize it in our pursuit of achieving each client’s unique objectives.

Our RiskSmart philosophy includes three component parts which address your portfolio, your fee exposure, and your tax exposure - all areas where the industry has failed you and where WealthFactor is helping you thrive.

PORTFOLIOSMART

Just like it’s nearly impossible to beat the house in Vegas, so is beating the market on Wall Street, according to investment history. So when it comes to achieving your investment goals we believe it's more about what you should avoid versus what you should do.

Thanks to passive investing, building a diverse investment portfolio is now free or nearly-free. But most financial advisors are primarily salespeople positioned as an “expert” and backed by a massive marketing budget and historical expectations. The result - underperformance, higher fees, and increased risk.

PortfolioSmart is one of the three components of our RiskSmart approach to investing and it has two parts:

1 - Avoiding Complexity

You can’t avoid complexity if you’re playing the game of utilizing multiple custodians and money managers, timing investment buys and sells, and riding the wave of esoteric investment strategies. This complicated approach requires more resources to manage, which means increased cost, and therefore a need for increased risk to make up for it.

2 - Avoiding Layers

You can’t avoid layers and potential confusion if your advisor is trying to pick and time funds that are picking and timing securities - with a middleman you will lose. Each layer makes it more challenging to understand what is really going on and to isolate issues, leading to a reduced probability of success.

FEESMART

Investing is only hard if you make it hard. The industry makes it hard because of their high fees. Investors should not pay 1% especially when their advisor is outsourcing the work!

Here’s the deal - building a broadly diversified buy-and-hold portfolio of stocks is not complex. It only becomes complex when we insert active decision-makers and layers of management. The investment management world has been in a race to near zero fees for years and yet investment advisors are still charging their clients 1% or more.

WealthFactor is built differently, offering a more efficient way to invest. Use personalized indexing (a variant of direct indexing, but with greater amounts of personalization) instead of funds whenever it makes sense to do so (more on this later!). We NEVER, never use mutual funds. We know first hand that they are grossly inefficient from both a fee and tax perspective.

The bottom line is this - we believe you shouldn’t overpay and that this industry doesn’t need to be so complex.

TAXSMART

Efficient tax management is under-appreciated by the investment industry and yet constructing a portfolio with taxes in mind may be one of the most significant ways an investor can improve their overall performance.

Many investment products, like mutual funds, are incredibly inefficient from a tax standpoint - your tax situation isn’t being considered by fund managers when buying and selling throughout the year AND new shareholders can be liable for gains in the fund that accrued before their investment. PLUS, other investor’s redemptions can trigger taxes you’ll owe. See what we mean?! This isn’t TaxSmart.

We build client-specific portfolios designed with after-tax returns in mind. It’s a simple idea that makes a big difference (more on this later in this post as well!).

So, from our seat at the table, it just makes good cents (see what we did there?) to be RiskSmart - to eradicate unnecessary risk and inefficiency in your portfolio, and shift the focus back on you and your unique needs.

DON'T START WITH GOALS

One way we make that shift back to you and your needs is to STOP focusing on goals first. Here’s what we mean…

WHAT’S FIRST?

When we say we don’t start with goals, we mean just that.

Rather than you having a goal in mind (like retiring to a tropical place, or leaving a huge legacy to your grandkids), and then finding a way to get you there, we instead start with measurable data to see exactly where you are beginning from.

Remember, we are real-ist experts, who avoid unnecessary risk (because it leads to an increased probability of failure) and we operate within our philosophy called RiskSmart - we always start with an evidence-based foundation of realism.

How? By determining your capacity for risk, specifically structural and behavioral risk.

WHAT IS STRUCTURAL RISK?

Structural risk measures your ability to absorb financial losses without putting your financial objectives in jeopardy.

All the data points that make your situation unique to you determine your structural capacity for risk, including:

- Your age (which plays less of a role as wealth increases)

- Your current assets

- The time horizon (how long until retirement or large life changes)

- Current activity on your accounts (what draws do you currently have)

- Other sources of income (such as social security or a pension)

- Significant health care needs (for someone in your household, or yourself)

These items are the closest to constants we have in the equation of your wealth and your risk capacity.

WHAT IS BEHAVIORAL RISK?

Behavioral risk measures your tendency to make investing mistakes due to your behavior or psychology. For instance, how well can you withstand the downside volatility of the market or might you make a decision that is reactionary? There is a large body of evidence from the field of behavioral economics on the biases of investors and common investing mistakes.¹ (¹Thinking Fast and Slow, Kahneman, 2001. / Misbehaving: The Making of Behavioral Economics, Thaler, 2016.)

At WealthFactor, we determine what your behavioral capacity for risk is and use that data to help you make informed decisions.

There are two ways to decrease behavioral mistakes:

- Through detailed understanding, education, and expertise

- By having a plan and a coach to help you stick to it

WealthFactor’s experts can assist you with both!

THEN WHAT?

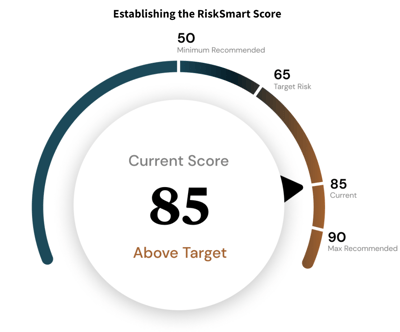

Once we’ve evaluated your structural and behavioral risk and assigned each a score from 1 to 100, the lower of these two scores becomes your MaxRisk score. This represents a limit on the amount of risk we recommend for you for a long term investment.

Next we allocate your investable assets into growth and stability buckets, filtering as needed to create a personalized index for your unique situation.

We will dig into all of this deeper in the next section of this post, but for now, it’s important to ask, do goals ever matter? And the answer is yes! There is a place for goals in our methodology. It just comes at the end.

See, the biggest negative to centering on the goal first is it removes the focus from the parts you can control that will impact your success. The focus needs to be on things that are defined and controllable. We don’t have control over the markets and what they produce. Simulations are rooted in the unknowable. There’s more that is unpredictable than predictable. To approach a portfolio with a return target isn’t effective.

What you can focus on is your structural situation and then filter your probability of your behavioral mistakes over the top of that. These should influence how much risk you take and determine how you invest. Goals come after that!

HAVE YOU STARTED WITH A GOAL?

It’s ok if you have.

But maybe it’s time to revisit the approach you’ve taken with advisors in the past and rework your portfolio from a risk perspective. Perhaps you’ve taken on more risk than is necessary and you’re paying higher fees as a result.

Start here with our RiskScore tool, to begin to determine your right-fit risk capacity.

OUR INVESTMENT APPROACH

As promised, let’s dig in and learn more about our passive investing methodology and what that means for your investments when you work with WealthFactor.

At WealthFactor our goal is to make managing your wealth simple, accessible, and transparent, right? One way we make this possible is with a realistic, expert approach to investing, as we’ve been discussing in this post so far - and that approach is using passive investing methodology.

Active investing involves a hands-on approach to portfolio management where managers research individual stocks and make trades in an attempt to outperform the market based on their beliefs, data, and sometimes quantitative analysis. Many advisors actively select underlying fund managers who do the work on their behalf. We think both layers of active management are 1) unlikely to add value over time and 2) increase costs. An active approach requires substantial research costs and generally has a higher turnover which leads to increased fees and reduced tax efficiency.

By contrast, passive investing involves buying and holding a set of securities over a long time horizon, typically with the objective of mimicking the return and risk characteristics of an index. Passive investing has the clear advantages of 1) simplicity 2) transparency, and 3) minimizing costs, such as research, transaction fees, and capital gains tax burden.

There is a significant body of research in academic finance which supports the notion that on average passive investing consistently produces superior returns net of fees over the long run. For example, Jensen (1968), Malkiel (1995), and Fama and French (2008) demonstrate that U.S. equity funds with active investment management significantly underperform passive investment strategies, net of fees.

RISK SCORING

In addition to passive investing, we believe having the right amount of risk is critical to investment success. We do not believe the mix of investment assets should be determined by a combination of goals, preferences, and objectives. Instead, we look to quantify what the right amount of risk is for each of our clients.

We break risk up into three core categories - we’ve already discussed the first two - behavioral risk and structural risk. The third is risk preference.

One’s preference for risk is just as it sounds. It’s not uncommon that an investor's capacity for risk exceeds their preference for risk. We believe an investment expert can help translate one’s preferences to make sure that extra or unnecessary risks are not being taken.

To start, we establish minimum and a maximum (MaxRisk) capacity for risk by evaluating their behavioral and structural capacities. We communicate this on a 1 to 100 scale.

A Risk Score of 100 represents a 100% growth-focused investment strategy, whereas a Risk Score of 1 is consistent with 100% cash holdings. In practice, we find that 90% of clients have a MaxRisk Score between 20 and 80.

We also consider an individual’s risk preference and their access to help from an investment expert. If, for instance, you prefer a lower level of risk than what your MaxRisk score indicates, that's acceptable! Also, if your behavioral score is lower than your structural score, having a MaxRisk score somewhere in the middle is also acceptable, but only with access to expert help to mitigate behavioral mistakes.

Adding these additional factors of investment expertise and risk preference together with the investor’s MaxRisk score allows us to finally determine the RiskSmart target for their portfolio. Once a client’s RiskSmart target for long term investment is established, we determine how to allocate their investable assets based on what we call buckets.

In WealthFactor’s investment approach there are two primary buckets, 1) the Growth bucket, which is primarily composed of publicly traded equities and 2) the Stability bucket, which is primarily composed of investment grade fixed income.

There are two main ways we invest in the Growth and Stability buckets: Personalized Indexes, made up of baskets of individual stocks, and ETFs.

PERSONALIZED INDEXING METHODOLOGY

WealthFactor’s Personalized Indexing Methodology seeks to deliver returns through buying and holding a diversified portfolio of publicly traded equities. We increase fee efficiency by removing the fund layer, manage concentrations to optimize risk, and increase the number of opportunities for a client’s portfolio tax management.

In the pursuit of providing personalization, we start with a universe of stocks, an index or multiple indices. For example, if a broad exposure to large-cap U.S. stocks is desired, then we may start with the Russell 1000 Index. Or, a personalized index of small-cap U.S. stocks may start with the Russell 2000 Index. We recommend personalized indexing for clients allocating more than $200,000 to stocks in large U.S. companies and/or more than $500,000 to small U.S. companies.

Then, we reduce this universe through filtering which may include the following:

- Factor: remove securities that do not screen for the value, profitability, or momentum.

- Size: screen out companies that are under a market cap of at least $2 billion to $5 billion.

- Dividends: screen out companies that do not pay a dividend of a certain percentage, if generating income is important.

- Sector exclusion: For those that have large percentages of their wealth or income tied to specific segments of the economy it may be valuable to avoid adding to that concentration.

- Environment, social, and governance: remove securities that do not meet certain criteria for responsible environmental, social, or corporate governance actions.

After the universe is narrowed through filtering and structural limitations are added to minimize risk both at sector and position level, each of these positions are purchased on behalf of the client.

When it comes to ongoing management of the portfolio, unlike direct indexing, a rules-based process is used to prioritize client specific considerations. Generally, our rules-based systems look more like a rebalancing, as the exposures and weightings of our portfolio move. For taxable accounts we typically prioritize minimizing taxes over tracking the index.

This can be a healthy phenomenon for a portfolio. Individual securities and sectors have historically exhibited periods of momentum; rather than try to predict this momentum, we instead utilize a multi-part rebalancing approach. On a more frequent basis we employ a “soft-rebalance”. In this rebalance we allow for increases in position and allocation size, allowing participation in the momentum. On a less frequent basis we employ a “hard-rebalance” returning all of the positions and sector weightings back to equal.

There are a few main advantages to utilizing personalized indexing.

- Remove a layer of management, which may reduce costs.

- Tailor a portfolio specifically to an investor’s income targets or tax situation.

- Tax management strategies, such as deferring gains and loss harvesting, are far more effective than with funds.

At WealthFactor, we believe personalized and direct indexing will be a disruptive force in investing for years to come.

Our services are built around proprietary technology that allows us to:

- eliminate unnecessary layers of management,

- efficiently implement our direct investing strategies, and

- pass these operational and trading efficiencies onto our clients in the form of lower fees for investment services.

THE WHY BEHIND OUR INVESTMENT APPROACH

We say here at WealthFactor that we are reimagining wealth services by removing the parts that don’t work and reworking the parts that do.

Plain and simple - we just approach this work differently than the industry norm. In particular, as we’ve discussed so far, we approach investing in a more passive way, and we’d like to explain the philosophy behind this methodology.

TRADITION

This industry is filled with a great deal of tradition and historical mindsets. Few advisors stray from the “way it’s always been done.”

Traditionally, investing is an active, hands-on activity involving managers who may be performing research and analysis in an attempt to outperform the market, earn you a big return, and bank their percentage.

And traditionally these hands-on efforts are initiated by a financial advisor who outsources to fund managers and other “experts” to actually perform said work or research.

The problem with this approach is unnecessary layers. You, as the client, have employed your advisor to be your trusted resource, to work on your behalf, and you are paying them to do so. But they aren’t likely experts in investing. Generally those that gain the trust of lots of clients are likely those that have primary skill sets that are sales and relationship management.

NEW STANDARD

At WealthFactor, we have removed the unnecessary layers of management, thus removing unnecessary risk, and we can provide actual expert advice and support for your complex needs at a fraction of the price as a result.

Our passive investing methodology draws from a strong body of academic research and evidence-based principles. History is filled with investment salesmen promising outperformance and not delivering. Rather than employ people trained in justifying increased risk taking driven by their higher fees, we’ve chosen the low fee, simple approach and actively seek to avoid all unnecessary risk taking.

WEALTHFACTOR AND RISK

In the traditional wealth management model, risk will be higher and is often an afterthought - something that must be assumed in order to beat the market and make enough return.

At WealthFactor, risk is considered from the beginning and will always be in the forefront of our approach.

Why?

Because the amount of risk you are comfortable with (behavioral) and that you can withstand financially (structural) should inform the actions we take, not the need for return to make up for high fees.

Likewise, your right level of risk should determine the actions we take together, not your desire for huge returns or financial goals (remember…. We don’t start with goals at WealthFactor!).

TRUE PERSONALIZATION

Another downfall of the traditional investment model is a lack of real personalization. Oftentimes advisors will get you into a model portfolio, “set it and forget it,” and not consider the uniqueness of your situation, tax considerations, or investment criteria.

At WealthFactor we know that no two client’s risk, needs, tax situation, or investing criteria will be the same. So, we put the effort into determining not just your right amount of risk, but the other unique parts of your situation so you receive investments that are actually right for you and your needs.

If you are tired of the status quo, financial advisors charging 1% or more to put you in funds, connect with us to learn more. |

Schedule a time with Bill Woodruff, our Founder, to get your questions answered and to learn more about the investment approach taken by WealthFactor.

|