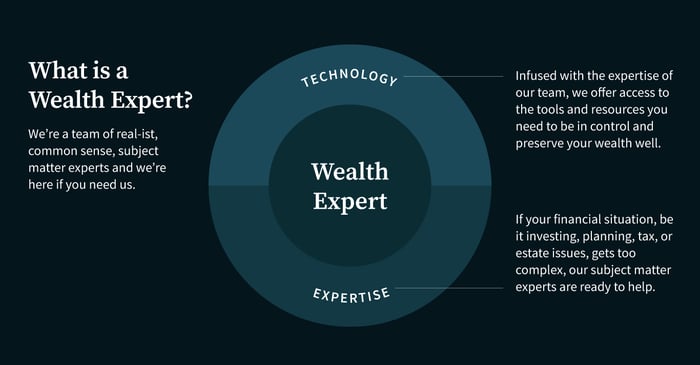

What's a Wealth Expert?

WealthFactor is committed to offering robust technology that gives you access to real wealth experts - not financial generalists like traditional wealth advisors.

We are tossing out the parts of this industry that don’t work and reimagining the parts that do to fit our vision of being a company that offers wealth services that are simple, accessible, and transparent (and that you aren’t overpaying for!).

One piece of this approach is our definition of Wealth Experts here at WealthFactor AND what you can expect from these wealth experts.

WEALTHFACTOR EXPERTS = REAL EXPERTS

Rather than building our business around deploying wealth advisors, asking them to go out and gather assets in the form of new clients, manage your money, help you plan, connect you with outside experts, etc, we've done things differently.

If you stop and think about it, are the skills needed to go out and sell someone on becoming a client the type of strengths or skills needed to navigate the complexity of global financial markets or tax and estate law? And are the outside experts an advisor is recommending (like a CPA or estate attorney) due to a reciprocal relationship rather than because they are a right-fit expert for you?

At WealthFactor, you are in control of building your team of experts based on your specific areas of need.

We think of ourselves as real-ist experts. We won’t tell you what you want to hear, but instead will use the data before us to provide you with the truth about your financial situation and look ahead to what is possible based on actual evidence. In essence, we are truth tellers and we’ve noticed that clients find this approach to be refreshing compared to other offerings in our industry.

To learn more about our risk first approach, take a look at these Insights posts on this very topic:

WEALTHFACTOR EXPERTS = PERSONALIZED

It’s common in the wealth services industry to set you up in an investment or planning model that requires very little personalization and that is intended for efficiency. The problem is that your individual needs aren’t being considered and attended to, meaning you are paying a high price (often at greater risk to make up for that higher price) for a less than personalized solution.

At WealthFactor, our experts do not “set it and forget it.” Instead, our methodology utilizes personalized indexing because we know that no two clients have the same risk profile, income needs, tax situation, or investing preferences. To assume so would be short sighted.

Not only can our experts provide this personalized approach, but with technology built for you, you remain in control - utilizing only the tools and resources you want and only paying for the services you need.

To learn more about how we employ personalized indexing techniques, read this Insights post: Our Investment Approach

WEALTHFACTOR EXPERTS = ACCESSIBLE

One of the biggest benefits of WealthFactor is the blend of technology and expertise. Rather than having to choose between the positive parts of a traditional wealth advisor and the pros of the robo/online advisor world, WealthFactor does both better. The outcome is accessibility.

You have access to the tools and resources you need to not only preserve your wealth, but control whether you are emphasizing things like income versus growth. And in the event that your investing, planning, tax, or estate situation gets complex beyond your own expertise, our experts are just a call or click away.

You have access to the tools and resources you need to not only preserve your wealth, but control whether you are emphasizing things like income versus growth. And in the event that your investing, planning, tax, or estate situation gets complex beyond your own expertise, our experts are just a call or click away.

Through our technology you can gain access to the expertise you need, when you need it, for the length of time you need it, and at a price that is both reasonable and reflective of your relationship with WealthFactor.

And when you do need an expert’s help, you know that there’s real people here, ready to assist you.

The bottom line is this:At WealthFactor we don’t take lightly the need for real expertise.And we understand that you might not always need help.So, you shouldn’t be paying the industry standard 1% for bundled services year after year when you may only need expert help once every few years. |

We’re a team of real-ist, common sense, subject matter experts and we’re here if you need us.

|

%20(8).png?width=350&name=Blog%20Image%20-%201080x1080%20(website%2c%20ig)%20(8).png)

%20(5)-1.png?width=350&name=Blog%20Image%20-%201080x1080%20(website%2c%20ig)%20(5)-1.png)