Our Investment Approach

At WealthFactor our goal is to make managing your wealth simple, accessible, and transparent. One way we make this possible is with a realistic, expert approach to investing.

At its core, WealthFactor’s investment approach starts with a close alignment to passive investing methodology.

Active investing involves a hands-on approach to portfolio management where managers research individual stocks and make trades in an attempt to outperform the market based on their beliefs, data, and some quantitative analysis. Many advisors actively select underlying fund managers who do the work on their behalf. We think both layers of active management are 1) unlikely to add value over time and 2) increase costs. An active approach requires substantial research costs and generally has a higher turnover which leads to increased fees and reduced tax efficiency.

By contrast, passive investing involves buying and holding a set of securities over a long time horizon, typically with the objective of matching the performance of an index. Passive investing has the clear advantages of 1) transparency, and 2) minimizing costs, such as research, transaction fees, and capital gains tax burden.

There is a significant body of research in academic finance which supports the notion that on average passive investing consistently produces superior returns net of fees over the long run. For example, Jensen (1968), Malkiel (1995), and Fama and French (2008) demonstrate that U.S. equity funds with active investment management significantly underperform passive investment strategies, net of fees.

Risk Scoring

In addition to passive investment, we believe having the right amount of risk is critical to investment success. We do not believe the mix of investment assets should be determined based on a risk preference or driven by goals or objectives. Instead, we look to quantify what the right amount of risk is for each of our clients.

We break risk up into two categories - 1) behavioral risk and 2) structural risk.

Behavioral risk measures an individual’s tendency to make investing mistakes due to their behavior.

Structural risk measures an individual’s ability to absorb financial losses without putting their financial goals in jeopardy.

One's preference for risk is just as it sounds. We believe an investment expert can help translate one's preferences into an actual portfolio.

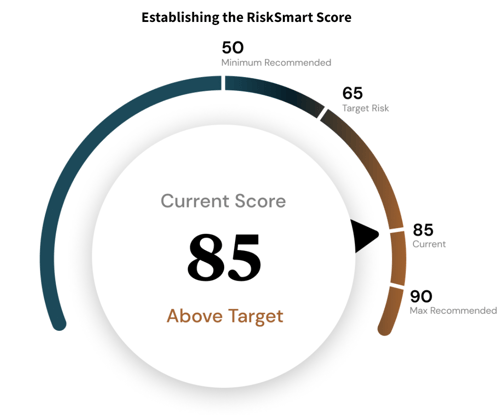

To start, we work with clients to establish a minimum and a maximum recommended risk by evaluating their current net worth, investable assets, and future cash flows. We communicate this as a recommended risk range on a 1 to 100 scale. Within this range, our risk module establishes a recommended target risk based on the individual investor's behavioral risk, investing experience, and risk preference.

Our risk module also establishes a recommended target risk based on the individual investor's behavioral tendencies, investing experience, and risk preference. We consider an individual’s risk preference and their access to help from an investment expert. If, for instance, you prefer a lower level of risk than what your target risk score indicates, that's acceptable!

Clients can choose to be guided by a WealthFactor expert when finalizing their target RiskSmart score that is right for their portfolio. A RiskSmart score of 100 represents a 100% growth-focused investment strategy, whereas a Risk score of 1 is consistent with 100% cash holdings. The majority of people have a MaxRisk score between 20 and 80. Once a client’s RiskSmart score for long term investment is established, we determine how to allocate their investable assets.

The Mix of Investments (Asset Allocation)

In WealthFactor’s investment approach there are two primary buckets, 1) the Growth bucket, which is chiefly composed of publicly traded stocks and 2) the Stability bucket, which is primarily composed of investment grade bonds. We further divide the Growth and Stability buckets into major sub-asset classes such as US large cap stocks, US small cap stocks, non-US large cap stocks, non-US small cap stocks, emerging market stocks, corporate investment grade bonds, and US treasuries.

There are two main ways we invest in the Growth and Stability buckets: Personalized Indexes, made up of baskets of individual stocks, and ETFs.

Personalized Indexing Methodology

WealthFactor’s Personalized Indexing methodology seeks to deliver returns through buying and holding a diversified portfolio of publicly traded equities. Plus, we increase fee efficiency by removing the fund layer, manage concentrations to optimize risk, and individually address client’s tax management.

In the pursuit of providing personalization, we start with a universe of stocks, an index or multiple indices. For example, if a broad exposure to large-cap U.S. stocks is desired, then we may start with the Russell 1000 Index. Or, a personalized index of small-cap U.S. stocks may start with the Russell 2000 Index. We recommend personalized indexing for clients allocating more than $200,000 to stocks in large U.S. companies and/or more than $500,000 to small U.S. companies.

Then, we reduce this universe through filtering which may include the following:

1) Factor: remove securities that do not screen for the value, profitability, or momentum factors.

2) Size: screen out companies that are under a market cap of at least $2 billion to $5 billion.

3) Dividends: screen out companies that do not pay a dividend of a certain percentage, if generating income is important..

4) Sector exclusion: For those that have large percentages of their wealth or income tied to specific industries it may be valuable to avoid adding to that concentration.

5) Environment, social, and governance: remove securities that do not meet certain criteria for responsible environmental, social, or corporate governance actions.

After the universe is narrowed through filtering and structural limitations are added to minimize risk both at sector and position level, each of these positions are purchased on behalf of the client.

When it comes to ongoing management of the portfolio, unlike direct indexing, a rules-based process is used to prioritize client specific considerations. Generally, our rules-based systems look more like a rebalancing, as the exposures and weightings of our portfolio move.

This can be a healthy phenomenon for a portfolio. Individual securities and sectors have historically exhibited periods of momentum; rather than try to predict this momentum, we instead utilize a multi-part rebalancing approach. On a more frequent basis we employ a “soft-rebalance”. In this rebalance we allow for increases in position and allocation size, allowing participation in the momentum. On a less frequent basis we employ a “hard-rebalance” returning all of the positions and sector weightings back to equal.

There are a few main advantages to utilizing personalized indexing.

1) Remove a layer of management, which may reduce costs.

2) Tailor a portfolio specifically to an investor’s income targets or tax situation.

3) Tax management strategies, such as deferring gains and loss harvesting, are far more effective than with funds.

ETFs

Exchange Traded Funds (ETFs) are pooled investment securities that have grown in popularity in recent years due to their many attractive features relative to mutual funds. In particular, ETFs are preferred for their low cost, diversification, and liquidity properties. Even with these positive properties, however, we find that ETFs can face limitations–discussed in the following section– in comparison to holding a properly constructed set of individual securities and that these limitations become more significant as the targeted allocation to a sub-asset class grows large enough. Consequently, , for clients who allocate more than a certain threshold dollar amount to U.S securities in the Growth bucket, we often build a personalized index.

At WealthFactor, we believe personalized and direct indexing will be a disruptive force in investing for years to come. |

Our services are built around proprietary technology that allows us to:1) eliminate the advisor layer of management, 2) efficiently manage portfolios of stocks based on indices, and 3) pass these operational and trading efficiencies onto our clients in the form of lower fees for investment services. Ready to learn more? |